The main points of this paper

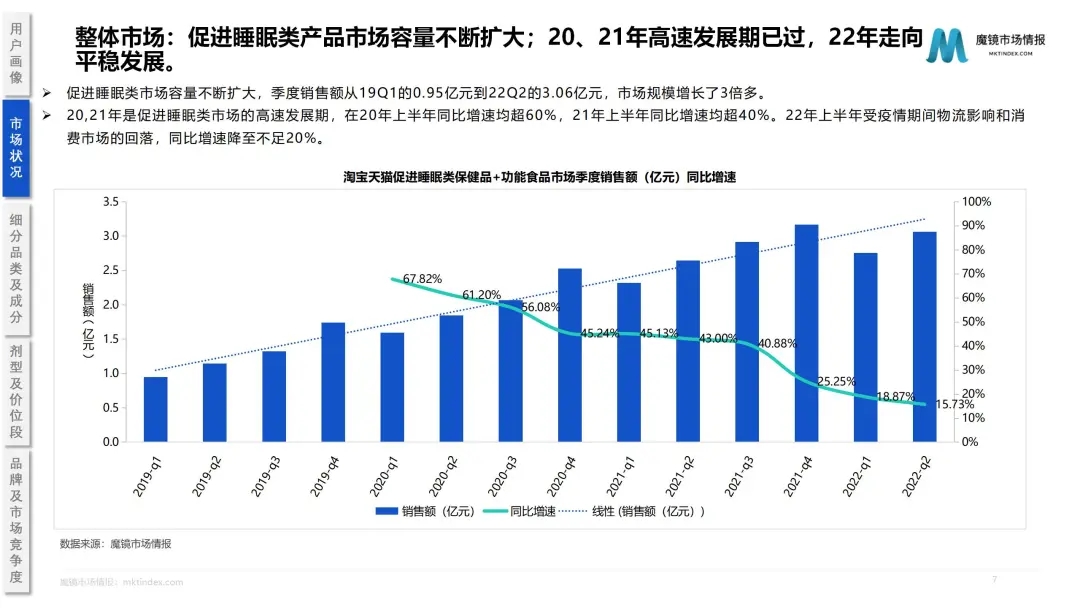

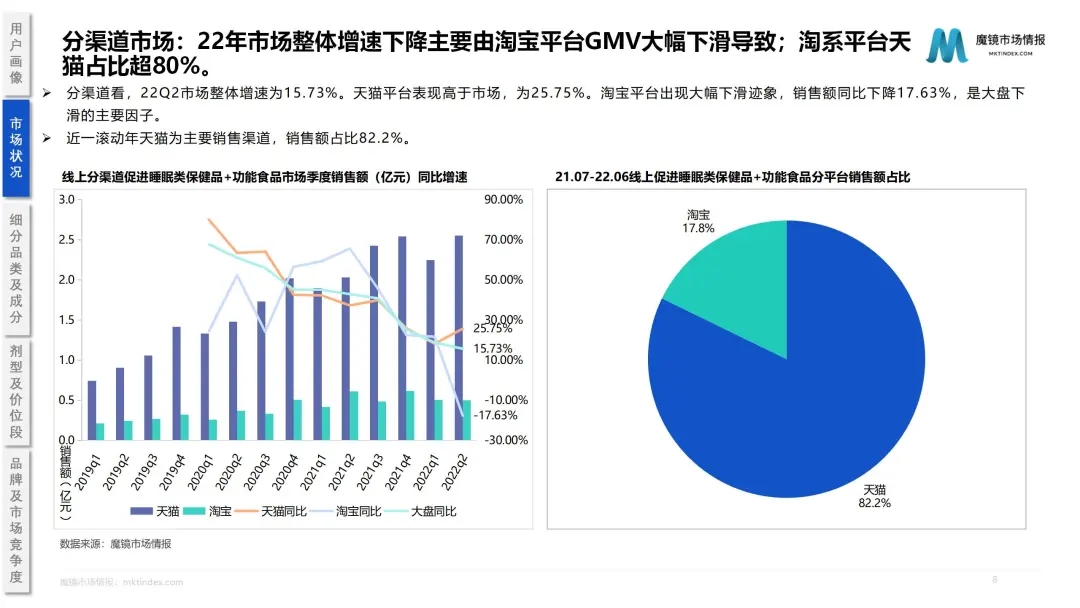

1. Promote the development of sleep market in 2022 years is relatively stable; Tmall accounts for more than 80%, and Taobao platform GMV has fallen sharply.

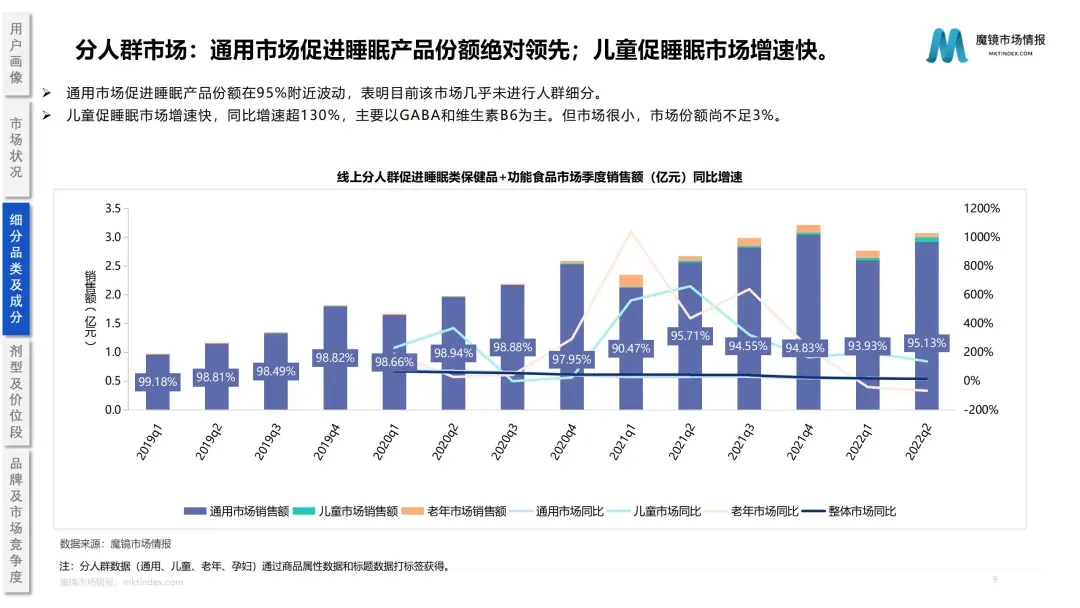

2. The general market promotes the absolute leader in the share of sleep products, with the share fluctuating around 95%.

3.GABA showed a year-on-year growth of more than 200 per cent in each quarter, significantly leading the market and still showing further high growth.

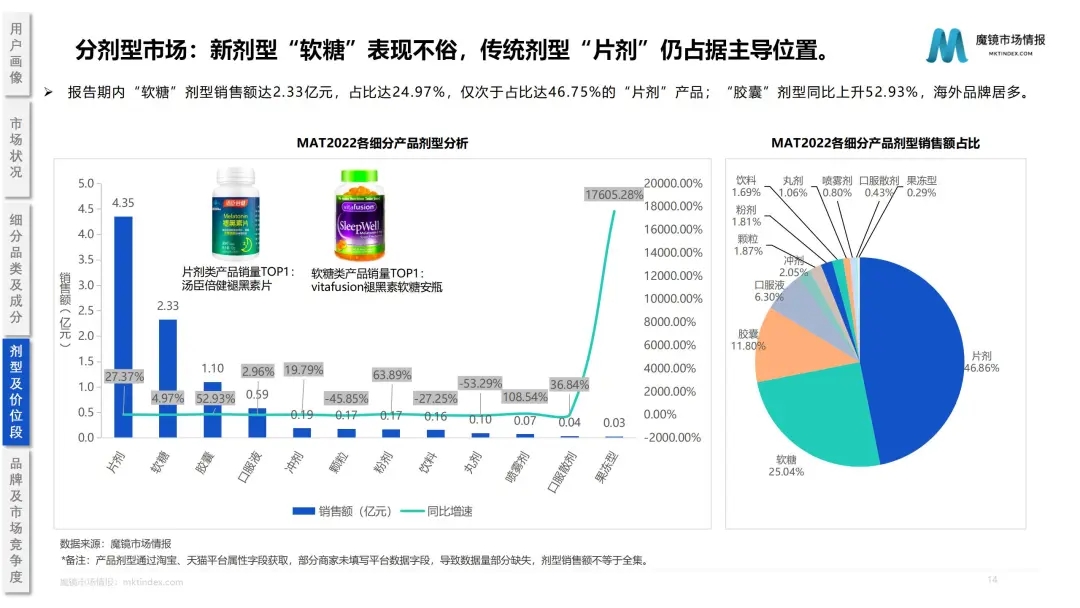

4. The traditional dosage form "tablet" still occupies the dominant position, and the emerging dosage form "soft candy" performs well.

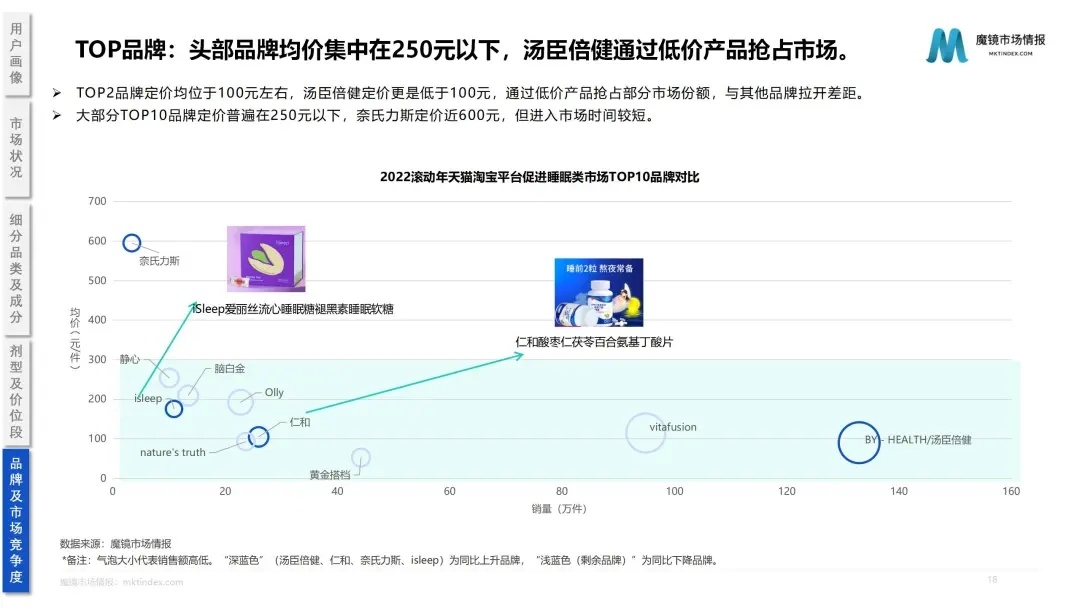

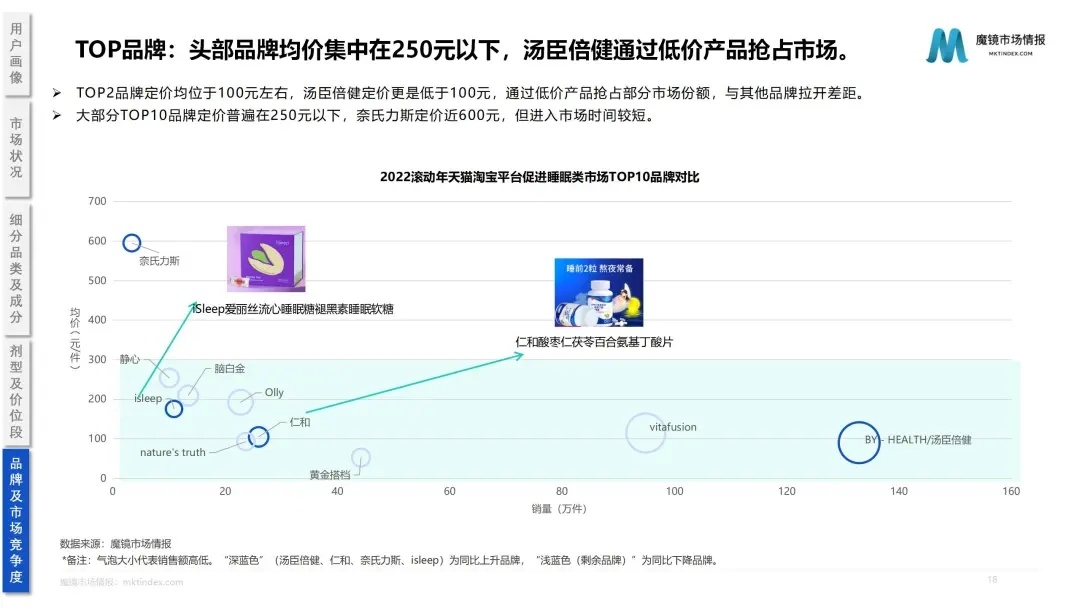

5.TOP2 brand market share is far ahead, and the share of overseas soft candy leading brands is reduced.

Sleep disorders may occur after long-term late sleep#,# do you have sleep procrastination#,# why can't young people quit staying up late with revenge# and other sleep-related topics are frequently searched. according to the sleep research report released by the China sleep research association, more than 300 million people in our country have sleep disorders. Demand spawns supply, multi-brand entry to promote sleep track, and home hardware homogenization competition is fierce, but to promote sleep-type health/functional food after the experimental product effect is more clear.

The results of the clove doctor's survey show that emotional problems (46%) and poor sleep (36%) occupy two of the top five health problems in young people. In terms of the market size of sleep promotion in China and the functional distribution of health foods approved in China in 2018, the proportion of relieving physical fatigue (10.9 per cent) and improving sleep (2.8 per cent) is still too small, with serious supply and demand asymmetry, and the sleep scene is worth digging.

Based on the above background, this study takes the promotion of sleep market as the research core, analyzes and predicts the growth focus of the promotion of sleep market in the future from the aspects of various sub-category markets and competitive brands, so as to help brands locate product attributes and target market segments. And combined with different dimensional analysis, such as from the crowd, composition, product dosage form, etc., insight into the new opportunities in promoting sleep track.

Market Status of Promoting Sleep

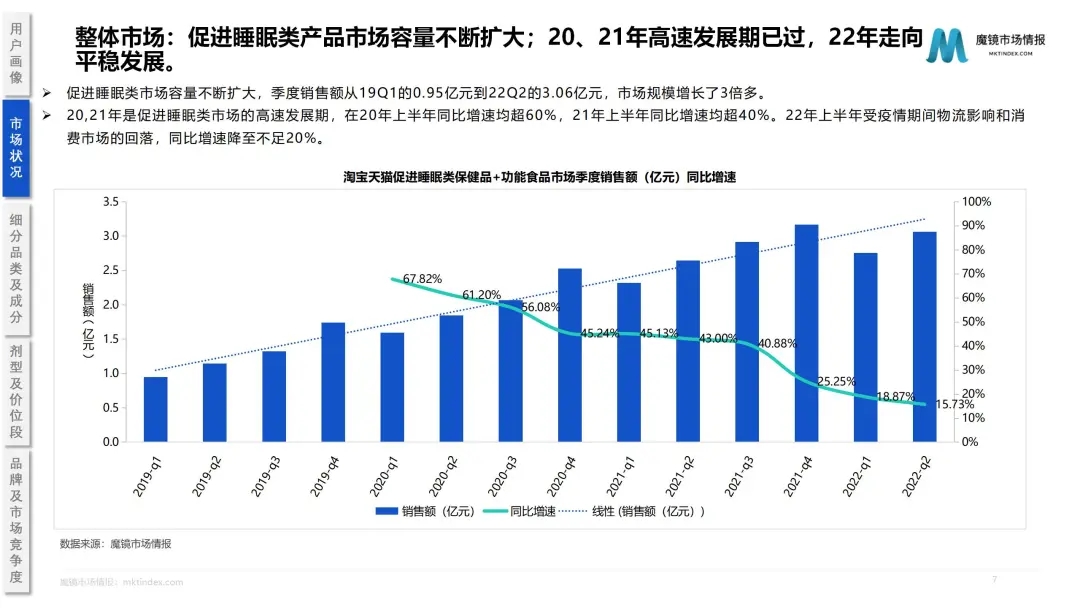

Overall Market Situation:The magic mirror data shows,Sales in the second quarter of 2022 were 310 million yuan , up 15.7% year-on-year.Sales in June 2022 reached 120 million yuan , up 7.7% year-on-year. The trend of promoting the expansion of sleep market capacity is obvious. In the first quarter of 2019, the sales volume was 95 million yuan , and the market size increased by more than three times. 2020 and 2021 are periods of rapid development to promote the sleep market, with year-on-year growth rates of over 60% in the first half of 2020 and over 40% in the first half of 21. Year-on-year growth fell to less than 20% in the first half of 2022 due to the impact of logistics and the decline in the consumer market during the epidemic.

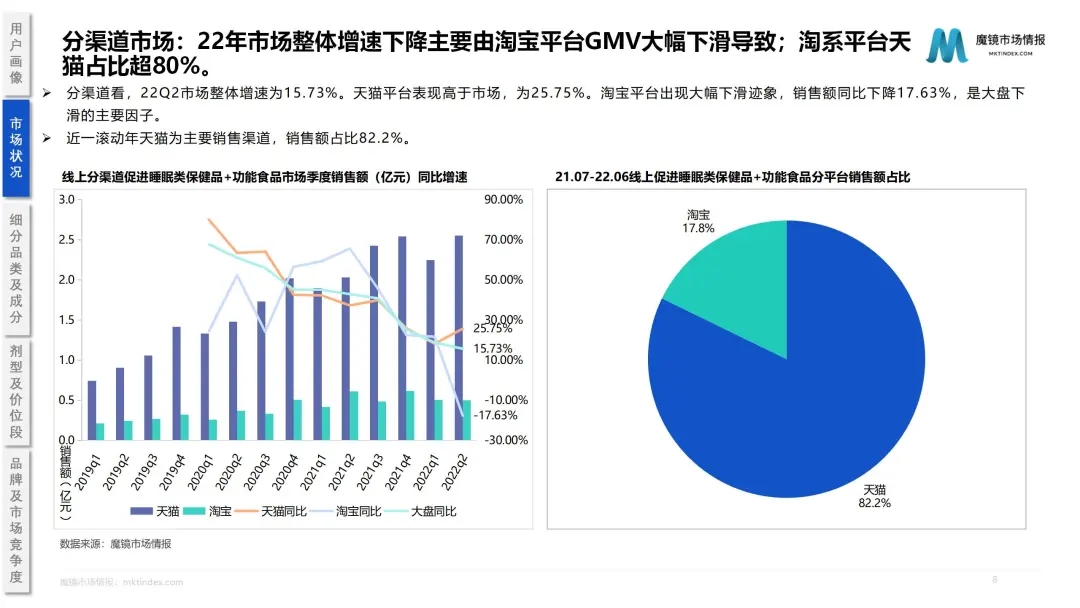

By channel, the overall growth rate of the 2022Q2 market was 15.73%. Tmall platform performance is higher than the marketThat is 25.75%. Taobao platform showed signs of a sharp decline, sales fell 17.63%, is the main factor in the market decline. In the past rolling year, Tmall was the main sales channel, accounting for 82.2% of sales.

Taobao platform is full of a large number of purchasing merchants, the cause of the epidemic situation led to the domestic port logistics blocked, the epidemic situation of serious national logistics directly cut off. Brands can only find factories or retrieve inventory in China, but purchasing merchants can only wait for logistics to open. The lengthening of the distribution cycle allows consumers to no longer rely solely on purchasing agents, thus turning to other ways to buy imported products.

Subdivided category and added component analysis

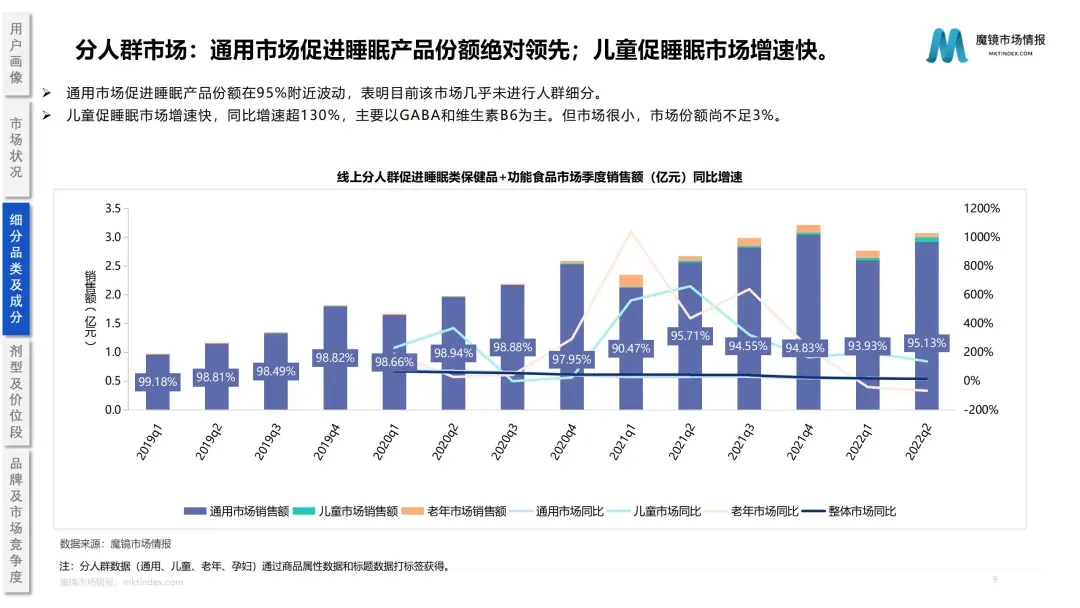

Sub-population market:The share of general market promotion sleep products fluctuates around 95%, indicating that there is little population segmentation in the market at present. Since 2021Q1 elderly market share increased, year-on-year growth of more than ten times, brand brain platinum, meditation (wife) and other precise positioning of the elderly market gift-giving scene, of which the brain platinum annual goods festival performance accounted for 37% of the annual sales. The children's sleep promotion market is growing fast, with a year-on-year growth rate of more than 130%, mainly GABA and vitamin B6. However, the market is very small, with a market share of less than 3%.

Market by category:Since 2021, GABA has shown a year-on-year growth of more than 200 per cent in all quarters, significantly leading the market,And there is still a further high growth trend.. If GABA can still grow at a 200 percent year-on-year growth rate over the next two years, and the melatonin market remains unchanged at its current trend,GABA is expected to surpass melatonin in 22Q4 to become the first major sleep promoting sub-category.

The growth of melatonin in the head segment is stagnant, and the secondary growth curve of the sleep market is expected to be led by GABA. Melatonin's market share has fallen sharply in the past four years, from 71.9 per cent to 54.9 per cent, while GABA, which is safer and has fewer side effects, has risen from 4.5 per cent to 28.3 per cent. Compared with the traditional melatonin, GABA is a natural amino acid, long-term use will not be addictive, no side effects. It is a good substitute for melatonin products.

Dosage Form and Price Segment Analysis

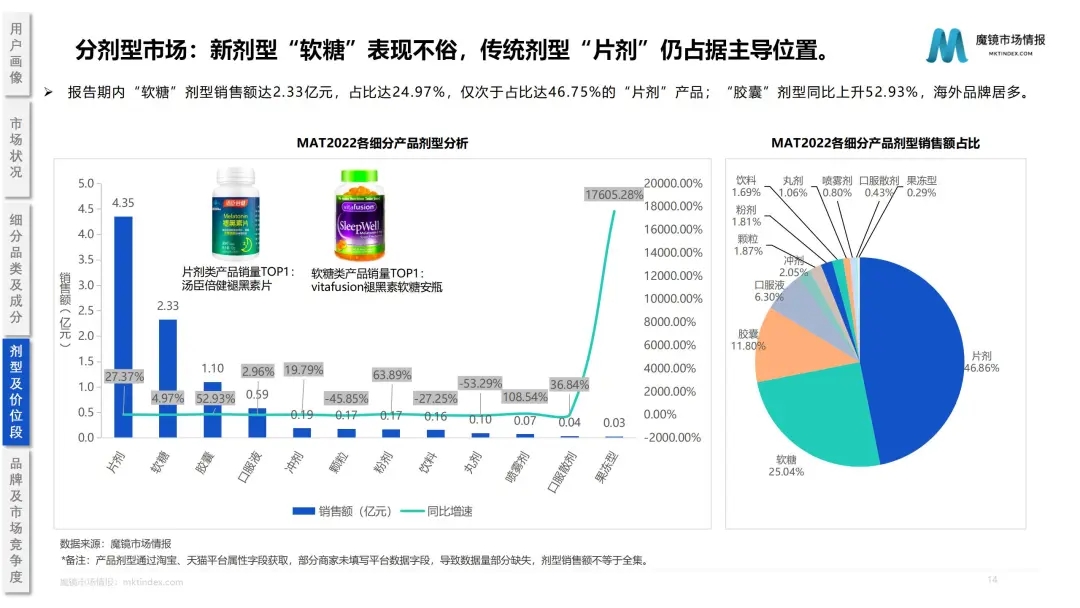

The new dosage form "Gummy" is doing well,Sales of 21.7-22.6 gummy products reached 0.233 billion yuan, accounting for 24.97 percent of sales., soft candy can be used for functional food on the sales of the dosage form products, capital has entered the bureau, according to the survey of iResearch Consulting, the amount of financing of start-up companies that include sleep soft candy products in start-up projects is generally at the level of 10 million, multi-brand entry to promote the development of sleep track. Traditional dosage form "tablets" still dominate, with 21.7-22.6 accounting for nearly 50%.

Products under 200 yuan accounted for 56.5 percent,Civilian price products still dominate. The sales volume of products with prices above 300 yuan accounts for 30.7. Most of the products are imported high-priced products and traditional gift-giving products. The brands include traditional gift-giving products such as gold partner and brain platinum. The proportion of this type of products during the New Year Festival is higher than that in ordinary months.

TOP brand and market competition

CR5 dropped from 40.4% to 30.9% in the past rolling year. The number of brands increased from 741 to 1102. Capital has entered the market. According to the survey conducted by iResearch, the financing amount of start-up companies including sleep aid health care/functional food in start-up projects Financing amounts typically range in the tens of millions. Multi-brand entry promotes the development of sleep track.

Brand BY-HEALTH ranked first in sales, entering big-name stores including "Tmall Supermarket". Overseas registered brand "BYHEALTH" entered cross-border e-commerce, contributing about 25 million yuan in sales.Renhe launched gaba and traditional nourishing raw materials compounded with sleep aid products, and at the same time increased marketing efforts on social media, with sales increasing by 492.03% year-on-year;vitafusion, olly and other overseas brands affected by the epidemic situation of the average price increased, vitafusion and olly market share decreased by 4.85 percent and 3.02 percent, respectively.

TOP2 brand pricing is located around 100 yuan,TOP1 brand BY-HEALTH through low-cost products to seize part of the market share, and other brands to open the gap.Most TOP10 brands are generally priced below 250 yuan, while Naturies is priced at nearly 600 yuan, but it takes a short time to enter the market. Sales of TOP2 brands BY-HEALTH and vitafusion account for about 80% of their products below 150 yuan. TOP2 brand sales are far from the third olly, at about 70 million yuan.

To promote the sleep market gradually entered a period of stable development, the number of brands increased month by month, the market concentration decreased significantly. Magic Mirror Found: The future sleep promotion market is dominated by melatonin or GABA products. Among them, GABA's market share in the next 1-2 years is likely to exceed melatonin. Due to consumption habits, the product dosage form is still the mainstream of tablets, but "sleep-aid soft candy" products have occupied an important position in the market.